MLB

Last week, Major League Baseball took the all-star game and draft out of Atlanta in a statement of protest against Georgia’s restrictive new voting law, SB 202. Cobb county, home of the Truist stadium where the All-Star game would have been held, estimates the lost tourism revenue at around $100m. That doesn’t include the lost advertising revenue and brand goodwill that Truist financial will endure because of the move. Clearly, Major League Baseball found the symbolism of the Georgia plantation painting under which the bill was signed, as ham-handed and inexcusable as everyone else.

Who’s come out against it

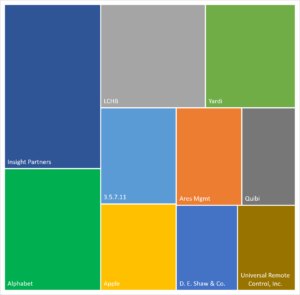

Their decision reflects the broader reaction to SB 202, which public sentiment has broken largely against. Maybe that’s why, in addition to the MLB, more than 100 companies have come out publicly against the law. So far, they include:

Additionally Ken Chenault and Ken Frazier (late of AmEx and Merck respectively) as well as 70 other Black executives published an unprecedented letter urging their fellow business leaders to get out in front of this.

Why is SB202 such a big deal?

SB202 is about one thing: voter suppression. It restricts the use of ballot drop boxes, criminalizes handing out food or water to voters waiting in long lines, allows state officials to take over local election boards, prevents the secretary of state’s office from automatically sending absentee ballot applications (as it did last year because of COVID), and removes the secretary of state as chairman of the state elections board, giving more control to the State party. A complete repeal of no-excuse absentee voting, included in an earlier version of the bill, was narrowly averted.

Besides the content of the law, the timeline in which it was passed points toward deliberate voter suppression. First, unprecedented voter turnout denied one party a presidential victory. After significant pressure was put on Georgia’s secretary of state to find votes, turnout flipped both of the state’s Senate seats Blue, delivering that body into the hands of the other party as well. Finally, the losing party responded with legislation to limit turnout with no evidence backing their stated reasons for doing so. This is not a sequence of events that supports the Georgia Republicans’ case.

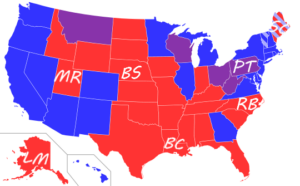

The wider legal context of this story also helps make sense of the exceptional reaction, by the MLB and others, to this one state law. As of March 24th, a total of 361 bills with provisions restricting voting access had been introduced in every state except:

As of that same date, Texas, Georgia, and Arizona had seen the most bills introduced. Georgia and Arizona are especially relevant because, as swing states, their electoral votes helped deny former President Trump a second term.

The bottom line is, the Georgia law isn’t the climax of this story. It’s the opening salvo in a much larger legislative war which, far from being its own thing, is more like a continuation of the bitterly disputed 2020 election. That means the degree of blowback to the GA law will help determine just how aggressively other states follow suit.

Response

The response to one party trying to legislate away its opponent’s margin of victory, has placed corporate America in the crossfire of dueling boycotts.

Because companies like the MLB have more power than ever to influence elected officials and voters have more power than ever to influence companies by organizing over social media, protesting has been quietly revolutionized. Traditional political activism has been infused with the new power of economic activism, turning commerce into a new political battlefield.

Corporations are the unwilling middle men in the new process, paving the way for a golden age of consumer activism.

The result in the moment is left and right each pushing companies to support their cause. The aftermath of the siege on the U.S. Capitol showed us that when corporate America feels strongly enough about an issue, they do more than make a statement. As of this moment, the MLB is the only organization taking voting rights seriously. The left wants to use boycotts to change that, the right, to ensure it doesn’t go any further.

Counter-Response

As usual, there’s been pushback to the pushback. Just this week, Minority Leader McConnell told CEOs to, “…stay out of politics. It’s not what you’re designed for.” His message was only slightly undermined by the immediate follow-up, “I’m not talking about political contributions. …I support that. I’m talking about taking a position.”

His statements sound dangerously close to, “give us money but don’t ask for anything in return,” which illustrates the difficult position the Republican party finds itself in with respect to fundraising. That’s because the GOP and its donors were largely responsible for opening the floodgates to corporate money in politics in the first place, culminating in the Citizens United ruling in 2010.

The Citizens United decision gave corporate speech constitutional protection and invalidated many existing campaign finance laws. The result has been a flood of undisclosed corporate money into elections.

At the time of the landmark decision, Senator McConnell said:

“For too long, some in this country have been deprived of full participation in the political process. With today’s monumental decision, the Supreme Court took an important step in the direction of restoring the First Amendment rights of these groups by ruling that the Constitution protects their right to express themselves about political candidates and issues up until Election Day. By previously denying this right, the government was picking winners and losers. Our democracy depends upon free speech, not just for some but for all.”

Clearly, he’s changed his mind, or at least tweaked it a bit.

Senator McConnell is not alone. Much of the modern GOP has greatly benefited from the Citizens United ruling. A paper published in 2016 found Citizens United to have boosted the chances of Republicans winning in state house races between 4 and 10%. After such clear electoral success, the party is now struggling with a business establishment pressured by its own consumers to resist them, using channels the party and its allies fought to create.

The Senator, in that same address, threatened companies with, “serious consequences,” if they continued speaking freely. Even though the Minority Leader left his meaning to the imagination, Georgia Republicans didn’t, voting in the state house to strip Delta of a $35m jet fuel tax credit after its CEO spoke out against SB202. ( Like 2018, when the GA legislature removed a $50m jet fuel tax credit after Delta ended discounts for the NRA, under social pressure in the wake of mass shootings.)

Similarly, another group of Georgia legislators recently announced they would no longer stock Coca-Cola products in their statehouse offices and a SC Congressman just introduced legislation that would strip the MLB of its monopoly exemption. These are fairly transparent examples of retaliation, more akin to Gilded Age power politics than, well, 2021.

Where Things Stand

The boycotts on the left are being led by AME Church and Black religious leaders throughout the southeast, given the law’s targeting of Georgia’s Black community. That boycott was supposed to start on the 8th, but has been paused until after a meeting between the boycott leaders and executives of the impacted companies.

The boycotts on the right are being led by no one in particular, but former President Trump and RNC chair Ronna Romney McDaniel have both endorsed them.

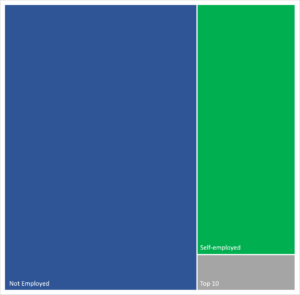

Besides the MLB, most major, GA-based companies have been roped into this political maelstrom. Only 3 have remained consistently at the center:

- Delta Airlines

- Home Depot

- Coca-Cola

So far, neither boycott has gotten organized enough to present a serious threat to any of them. The developing political situation will determine if that organization happens.